2013 was a busy year for many employers; the introduction of auto-enrolment in pension schemes plus the move to real time reporting for PAYE meant significant work for businesses all over the country.

But no sooner than you have breathed a huge sigh of relief to have succeeded during a busy 12 months, than the next year is upon year. And 2014 promises to bring just as many changes as 2013.

We take a look at what lies ahead in the coming year and the changes that 2014 could bring for payroll and employment.

Auto-enrolment

Yes, it’s that subject again! Although auto-enrolment was introduced to many companies during 2013, it hasn’t yet been rolled out to everyone.

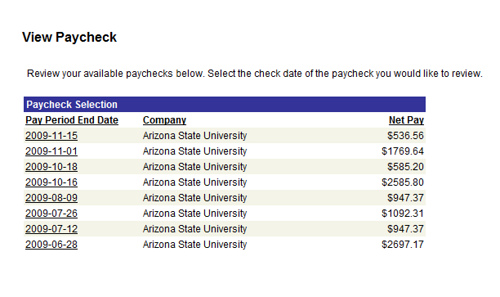

There are different software’s that can be used to automate your payroll.

Image source: https://www.easynetmoney.net/wp-content/uploads/2014/01/3343490845_87c6a8fa8e1.jpg

If it seemed that during the last 12 months, auto-enrolment was the subject on everyone’s lips, it’s going be even more pronounced during 2014. Eight times as many companies are due to join the auto-enrolment scheme in the year ahead compared to those that have already joined.

If auto-enrolment has already been completed for your employees, you might be pleased to know about a change which is due to take effect from April 2014. At present employers have just one month to provide employees with information about their joining rights and to achieve active membership. Legislators have recognised that in many cases this can be problematic for employers as entitlement may not be fully calculated until close to the first payday. This window is being extended from one month to six weeks to help employers meet their obligations more easily.

Flexible working

Although this right is already in place for working parents with children aged under 17 and carers, the law is changing to extend the right to request flexible working to all employees.

This does not mean that the right has to be automatically granted, but a formal response must be given by the employer within 14 days of a formal meeting being held.

Flexible working often creates challenges in smaller businesses whilst others benefit from the more diversity amongst their employee’s working hours. If your company receives and approves more requests for flexible working, expect to see a substantial increase in the amount of administration for your payroll.

In addition to this, new parental leave laws come into force in 2015 which allow it to be shared. This is likely to result in individual and complex payroll arrangements for employees and will inevitably require plenty of planning and preparation during 2014 to get ready for implementation the following year.

Taxation changes

In the 2013 Budget, a number of changes were announced which are due to take effect from the 2014/2015 tax year.

Amongst these is the increasing of the personal allowance limit to £10,000 for individuals born after 1948. The rate at which tax at the higher rate becomes payable will move to £41865 (personal allowance plus basic rate band).

Tax changes can affect payrolls.

Image source: https://www.easynetmoney.net/wp-content/uploads/2014/01/4174305366_bf7c12b2a5.jpg

National Insurance contributions will by and large remain unchanged during 2014 but in 2015 significant changes will take effect. Contributions for those under the higher rate tax band will be scrapped for individuals aged under 21, saving around £500 per year for employers. In addition, a new category of National Insurance will be introduced, allowing individuals the chance to top up their Additional State Pension, should they choose to do so.

These impending changes, plus the taxation amendments required for 2014 will require substantial administration within a payroll team, particularly if wages and contributions are worked out manually, or are held on a paper-based system.

Conclusion

As we move swiftly into 2014, many challenges lie ahead in the coming 12 months and it promises to be another busy year for payroll administration. 2015 is already shaping up to also hold a number of significant changes which will require forward planning in order to meet the deadlines. If the thought of this causes you to break out in a cold sweat, or you think your existing staff might struggle to cope with surges in the workload, you might want to consider using an outsourcing payroll service. They can help either on an ongoing basis or with one-off projects which stretch your existing staff beyond their capacity.

Image credit: xposurecreative and twak