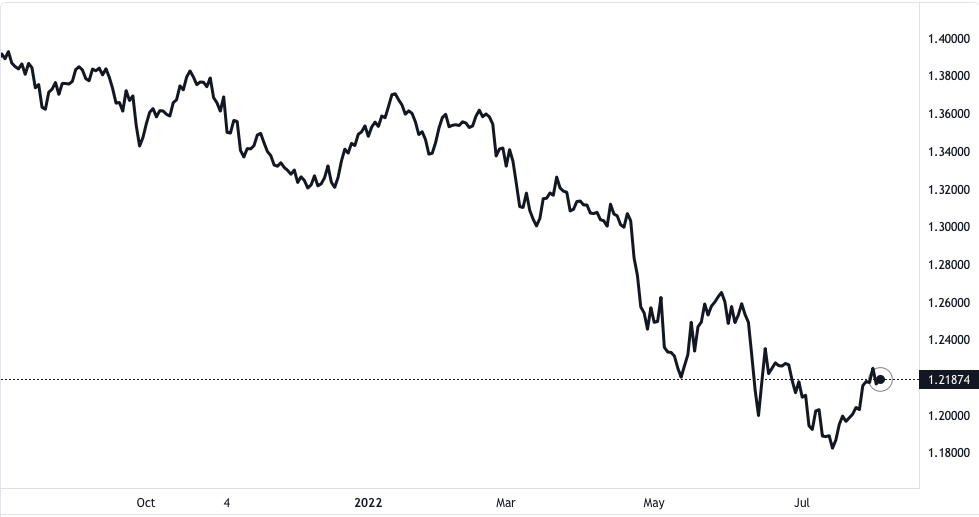

The GBP/USD currency pair has shot beyond its immediate obstacle of 1.2172. This comes as investors choose to ignore the brewing tension between the US and China over House Speak, Nancy Pelosi’s, visit to Taiwan. The investors returned en masse to risky currencies.

The US vs China

The cable pair had remarkable bids under 1.2140 and showed an upward movement. The asset has now shown an intraday height of about 1.2175 and it is likely to still prolong its gains.

GBP/USD price chart. Source TradingView

The risk-sensitive currencies had earlier been underperforming in the face of the recent tensions between the US and China. The political development also improved the market’s appeal for safe-haven assets in the meantime.

It is expected that the US Dollar index will have a slight pullback. The Dollar index will possibly be entertaining to short-term investors as the market waits for the Non-farm Payrolls reports. The report is scheduled to be published on Friday.

The employment report is also likely to maintain a downbeat status. This is because market players are currently expecting some lower shift in generated employment. The figures are expected to come in at 250,000 against the last figure of 372,000.

The unemployment rate is equally expected to be unchanged at the last figure of 3.6% it came at. Investors should not be oblivious to the fact that the US economy currently operates at a complete employment level. An extended increment of creating jobs at an increasing rate cannot be sustained.

UK Politics Holds BOE Back

Nevertheless, the market expects a satisfactory increase in both data releases. In the United Kingdom, investors are hoping that the Bank of England comes up with another rate increase. The bank is due to have another monetary policy meeting scheduled to come up on Thursday.

The Bank of England Governor, Andrew Bailey, is speculated to announce a 25 basis points increase. Note that the country’s inflation rate stands at 94%. An interest rate increase of 25 basis points might not be sufficient to offset the current price pressure.

Nevertheless, the low economic indicators, as well as the political situation, are holding the Bank of England back. It cannot go all the way in at this period.

Several other factors add pressure on the currency pair especially the consumer inflation in Europe. This has been further escalated in the energy phase as most of Europe depends on energy from Russia.