Weak Asian Session Spreads to Europe

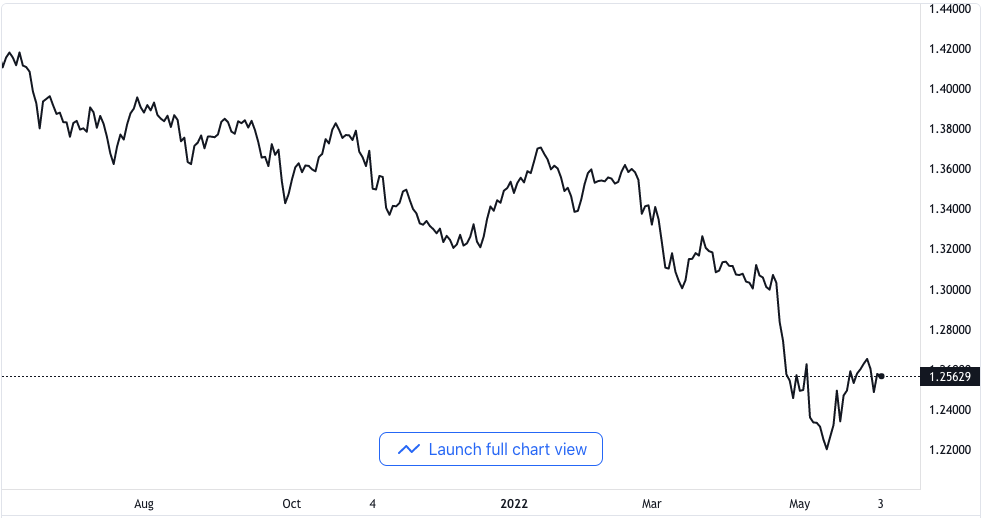

The GBP/USD currency pair is going to and fro between the range of 1.2565 to 1.2590. It seems like a lukewarm Asian session is going into the European movement. All attention is now fixed on the coming Non-farm Payroll report from the US.

The US market is expecting to see the NFP, unemployment data and the Service sector’s Purchasing Managers’ Index all on Friday. The market has reduced its expectation of what to expect from the Non-farm Payroll.

GBP/USD price chart. Source TradingView

The first estimate for the employment data to report was 325,000. The poor Automatic Data Processing Employment Change reduced the expectation to 225,000. The rate of unemployment is speculated to reduce by 3.5% against the last print of 3.6%.

The whole data from unemployment shows the tight labor market trend will continue. But the employment rate is expected to reduce significantly.

Aside from the data coming from employment, investors will equally give further attention to Services PMI. An initial estimation of the Services Purchasing Managers’ Index is pointing to poor performance. The economic catalyst might come in at 56.4 versus the last print of 57.1, as expected.

While at that, bulls of the British Pound pushed it higher on Thursday. The higher price came in with the positive sentiment that followed the market rebound. Risker currencies pulled some traction in the course of Thursday’s trading.

Further Effects on the Market

The effect of the market’s sentiment could be seen in the ten-year US Treasury bond yield and the S&P 500 futures. Both entities struggled around 2.91% and 4,175. More so, if the benchmarks on Wall Street increased to the highest on Thursday.

Statements from Sarah Bianchi posed the most recent challenge to the market’s mood. She said the USTR is looking for a realignment with China. She also said all options are up with regards to tariffs on Chinese export.

Bianchi, in the same statement, called for rapid trade negotiations with Taiwan. It is a move that will not be appreciated by the Chinese. It, therefore, poses a challenge to the GBP/USD pair.

Similarly, the Chinese Foreign Ministry’s spokesman condemned the US order that banned imports from Xinjiang.

Reduced activities around the Pound will give momentum to speculations about inflation. It would also heighten discussions about increasing interest rates in the United Kingdom.

The Bank of England should keep directing interest rate increases as it is the only way to combat inflation. Investors need to know that the UK inflation is stabilized at over 9%.